Background

A leading global medical device manufacturer faced a pricing strategy challenge and partnered with Veranex (formerly Boston Healthcare Associates) to identify appropriate prices for a suite of three products aimed at the low-end, mid-range, and high-end of the urology market.

The products, which included a capital component and disposables, had over 20 different features that could differ across models; some features were available only with certain products within the device family.

Competitors on the market provided low-tier and mid-tier offerings. The capital equipment was available for purchase or lease, and the manufacturer was interested in testing a wide range of capital equipment prices, with the highest tested price being over 750% larger than the lowest.

The client requested Veranex’s support to identify an optimal business model to drive adoption of a new next generation platform, customer willingness-to-pay, and key value drivers and differentiators.

Key Business Questions

Who are the key stakeholders for the technology, with specific regard to stakeholders influencing purchasing and adoption?

- What are the main unmet testing needs by physician segment?

- What are the product characteristics that drive adoption and what are they key value messages?

- What is the optimal business model (buying or leasing) for encouraging product adoption?

Veranex’s Approach

We weighed the advantages and disadvantages of pricing methodologies used to determine optimal prices, including conjoint analysis and a Gabor Granger / Van Westendorp methodology involving open-ended questions and questions about specific test prices for different scenarios.

With conjoint analysis, we estimated that at least 100 participants per specialty would need to complete a minimum of 15 product choice tasks, each of which would require physicians to select a product from five hypothetical product designs (described in terms of seven to nine product features).

Advantages and Disadvantages of Pricing Methodologies for a Global Medical Device Client

| Methodology | Advantage | Disadvantage |

|---|---|---|

| t | t | t |

| Conjoint Analysis |

|

|

| Gabor Granger / Van Westendorp Methodology |

|

|

Veranex decided to employ open-ended questions to solicit unbiased pricing expectations, followed by questions about physician likelihood to purchase devices at specific prices of interest to the device manufacturer.

To determine product pricing expectations and identify key drivers to barriers to adoption, Veranex conducted primary research in two phases:

- In-depth phone interviews with 10 clinicians and two hospital purchasers

- Quantitative online survey with 150 clinicians

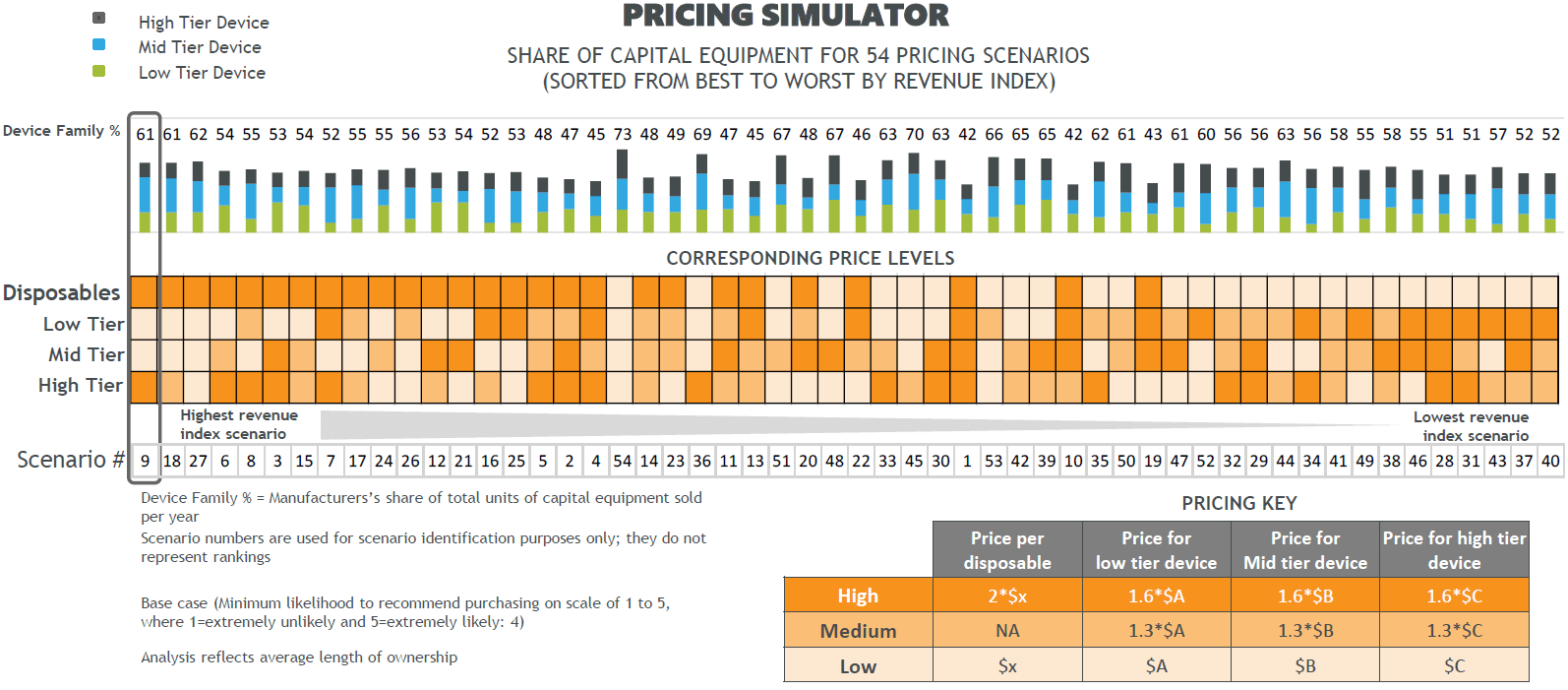

Veranex created a pricing simulator (Figure 1) to model clinician reaction to 54 different pricing scenarios to inform revenue potential at different price combinations.

Figure 1. The 54 scenarios presented are in order of revenue, with the revenue-maximizing scenario on the left. The orange boxes indicate the price levels tested, and the bar graph along the top indicates the share represented by each device in the product family.

Value to the Client

The simulator:

-

- Calculated the expected peak market share by physician specialty and by product type

-

- Identified the revenue-maximizing price scenario and the market share-maximizing price scenario

-

- Provided data on the price sensitivity of clinicians interested in each of the three options within the product family

-

- Enabled a sensitivity analysis to determine how results might change based on different purchase likelihood thresholds

Takeaway

For Medical Device companies that have large product families, the simulator serves as an essential tool for guiding recommendations on the optimal price points across the suite of products.

By employing the chosen methodology, Veranex was able to:

-

- Confirm which types of individuals are crucial in device adoption decisions

-

- Understand how the devices are used, which product features are most important, and how institutions decide to buy versus lease

-

- Identify prices that would or would not influence a physician’s decision to recommend purchasing or leasing the preferred device

-

- Develop a comprehensive pricing simulator that

-

- Displays the revenue-maximizing price scenario and the market share-maximizing price scenario

-

- Provides data on the price sensitivity of clinicians interested in each of the three options within the product family

-

- Facilitated a sensitivity analyses to determine how results might change based on different purchase likelihood thresholds

-

- Develop a comprehensive pricing simulator that

Veranex’s work was foundational in building an effective pricing and contracting strategy for the client’s new product introduction, optimized within the context of the overall portfolio pricing management strategy.

For more than 25 years, Veranex has provided best-in-class strategic consulting services focused on value and access-related issues for emerging and established medical device, diagnostics, pharmaceutical, and health informatics companies. Contact us to learn how we can help unlock the value of your innovative products or services.